Waste Market Overview & Outlook 2019

Click Image to Enlarge

Click Image to Enlarge

Click Image to Enlarge

Note: 2025 Report to be Released Soon

The Waste Market Overview & Overview for 2025 will be released in the coming weeks. It details the now $105 Billion US waste industry, its key players, business segments and the continuing evolution of the industry.

The Waste Market Overview provides a very detailed analysis of the entire waste industry, examining the key business segments, and the evolving role of the major players. It examines the industry top to bottom covering waste generation, collection, processing, recovery and disposal by revenue and volume. The report details the relationship of past and future pricing to capacity and demand for disposal and shows the increasing role of the private sector. Waste equipment and the emerging importance of e-waste, C&D recovery, organics and food wastes, tires and medical wastes are also examined in detail. An accompanying Excel file details waste generation, recovery, movement among states and disposal in landfills and conversion to energy by state, region and for the entire U.S. by year from 1992 through 2019 and includes projections through 2023.

-

Market Revenues by Segment

-

Waste Generation, Recovery and Disposal by Volume and Revenue

-

Collection, Processing and Disposal Markets

-

Geographic Distribution of the Market

-

Other Waste Management Segments & Emerging Markets

-

Competition in Waste Among the Major Players

-

Resource Recovery Markets by Commodity

-

Waste Management Equipment

Report: 363 pages, includes tables, charts and graphs.

View the Table of Contents, List of Exhibits, and List of Tables.

New Report Details the $76 Billion U.S. Waste Industry

Waste Market Overview & Outlook 2019

With all the bad news focused on the trouble with recycling it's easy to overlook the overall strength of the U.S. waste management industry which grew by nearly 4 percent last year to $76 billion. Waste Business Journal's 363-page report: The Waste Market Overview & Outlook 2019 details the industry, its business segments, key market participants, and how they interact with one another and the overall economy.

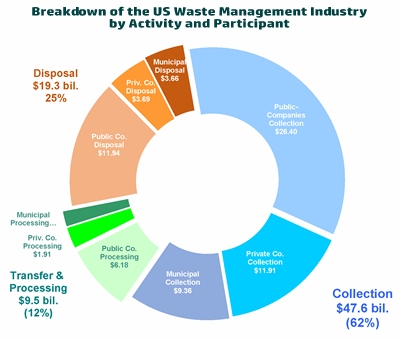

Last year the trend towards increasing privatization continued as publicly-traded companies accounted for 60 percent of industry revenues. That is up from less than 50 percent in the early 90s when municipalities accounted for 35 percent of revenues. Municipalities account for just 19 percent today. The business of waste is 62 percent collection, 12 percent recycling and transfer, and 25 percent disposal, which includes landfilling and to a much lesser extent, waste-to-energy.

Source: Waste Business Journal

Components of the Waste Stream

The report details with historical and projected statistics of four primary non-hazardous waste streams: municipal solid waste (MSW), organic wastes, construction and demolition debris (C&D) and non-hazardous industrial and special wastes. The report estimates that the U.S. generated 456 million tons, or 7.6 pounds per person of MSW last year. This figure is significantly more than U.S. EPA estimates, but Waste Business Journal figures are based on individual facility surveys of every waste processing and disposal operation across the country. That includes landfills, transfer stations, recycling facilities, waste-to-energy plants, composting operations and more.

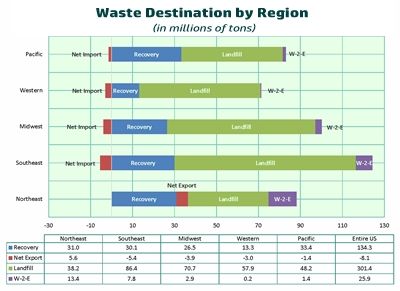

Of that 456 million tons of MSW, we recycled (or composted) 29 percent leaving 301 million tons (66 percent) that was landfilled and 8 million tons (6 percent) that was burned for energy recovery. The U.S. imported 8 million tons from other countries, mostly Canada. Publicly-traded companies handled 58 percent of total landfill volumes, while private companies accounted for 14 percent and municipally owned landfills 28 percent.

Pricing Increases…Companies Share the Added Costs of Recycling with Customers

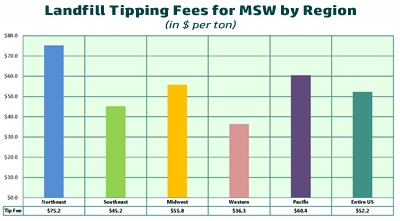

Meanwhile, landfill tipping fees have grown steadily over the years in line with inflation, growing demand for disposal amid fewer landfills and because the big firms have exercised more pricing discipline in recent years by avoiding costly battles over market share. The national average tipping fee for 2018 was $52.20, up from $32.90 in 1998. WTE tip fees showed slightly more variability over the 20-year timeframe. Tipping fees vary widely be region and in accordance with the availability of landfill capacity amidst population density and demand for disposal. Prices have risen faster in the Midwest and southeast as waste is exported to these regions from the Northeast.

Source: Waste Business Journal

Increased Efficiencies through Vertical Integration

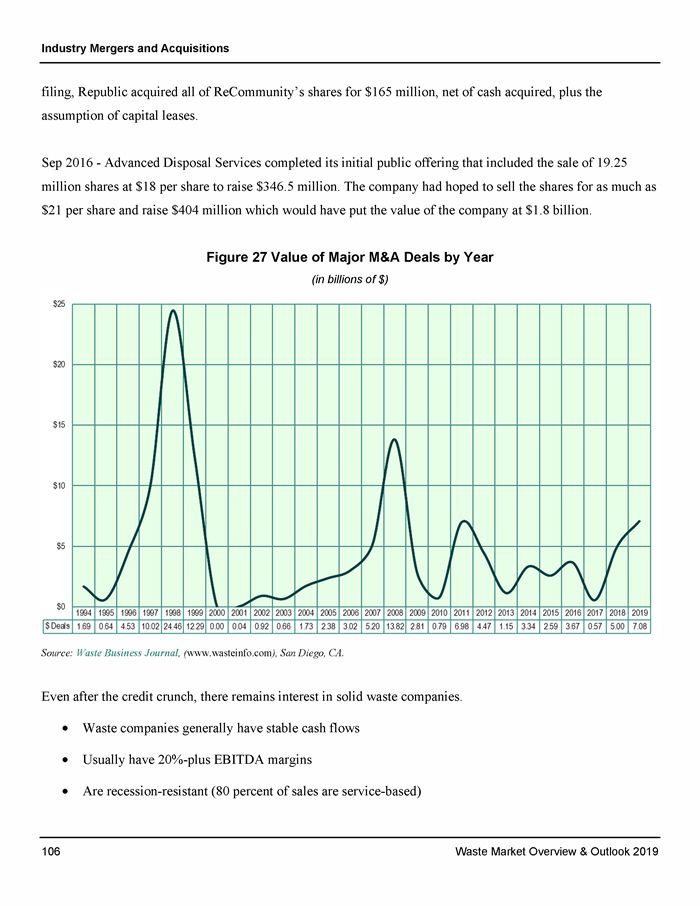

Recent mergers including Waste Management's proposed takeover of Advanced Disposal, promises a reshaped industry much further along its path of privatization and concentration. The companies understand that one way to deal with turbulent economic times amidst rising fuel, labor and equipment costs is to streamline operations and vertically integrate their markets. Integrated companies can better utilize their landfills by controlling a greater percentage of surrounding collection assets.

Landfill Capacity Expected to Contract Further… Especially in the Northeast

Landfills themselves are becoming more important as old sites close, demand for disposal steadily climbs, accelerated by recycled materials sent there that have been collected but have no market since China imposed much more stringent requirements. Consequently, remaining landfill capacity which has hovered around 20 years for the last decade, is expected to shrink to just 17 years by 2022. Landfill capacity is especially critical in the Northeast where capacity is expected to shrink to less than 10 years by that time.

Source: Waste Business Journal

Renewed Focus on Hedging Costs

Rising costs have focused company managers on disciplined price increases especially now that the industry is more consolidated, making them more attentive to return on invested capital, more rational about valuing existing landfill capacity and mindful of lessons in the past when pricing was sacrificed.

Past volatility of fuel costs and recent volatility in recycled commodity prices have led waste firms to share those increases with customers by adding surcharges to their contracts. Expect to see continued focus on controlling vehicle maintenance and insurance costs while investing in fleet upgrades and worker safety programs. Additional cash from operations will likely go towards "tuck-in" acquisitions, asset swaps and other vertical integration measures for which companies can reap immediate cost savings.

Relatively low natural gas prices together with a growing infrastructure of fueling facilities is leading companies and municipalities to invest in converting their fleets to compressed natural gas (CNG) and liquefied natural gas (LNG) powered vehicles. Other benefits including lower emissions and quieter engines makes the fleets more welcome to the communities they serve. While helping the collection profitability, low natural gas prices are hurting the waste-to-energy business. Only one new mass burn plant has been built since 1995 and many waste conversion plants proposing to use advanced technologies have either been discontinued, cancelled or put on hold.

Other Segments and Waste Streams Covered:

-

Construction and Demolition Debris Generation, Recovery and Disposal

-

The growing problem of E-Waste, Legislation, Processors and Solutions

-

Renewed focus on Organics and new Food Waste Programs

-

Scrap Tires, Recycling and Conversion to Energy

-

Waste Industry Equipment, Manufacturers and Segments

And much more…

Comprehensive Dataset Included

Included with this comprehensive and detailed 363-page report is an Excel dataset that includes historical and projected data on waste generation, recovery, exports, and disposal by landfill or WTE, remaining capacity and tipping fees for each major category of waste. The waste streams are broken out by MSW, organics, C&D, and industrial wastes. The statistics are aggregated by state, region and for the entire U.S.

CONTENTS OF THE REPORT

1 ABOUT WASTE BUSINESS JOURNAL

1.1 About James Thompson, Jr.

1.2 Disclaimer of Warranty

1.3 Discrepancy with Numbers Published by the US EPA

1.4 Research Methodology

2 RECENT EVENTS & HISTORY

2.1 Market Overview

Industry Revenues Have Grown Steadily

Composition by Market Participant (towards industry consolidation)

Composition by Activity

Waste Generation and Recovery

Disposal Pricing

Remaining Landfill Capacity Projected to Shrink by 2023

Landfill Capacity by Market Participant

2.2 Recent Events

China's Ban

Further Industry Consolidation

Food Waste gets More Focus

Franchise Markets in LA and New York

Laissez Faire EPA

States Move to Regulate Coal Ash Themselves

First New WTE Facility in 20 Year Opens

Increased Focus on Industry Safety

Ongoing debate over how to define "zero waste"

Ever Newer and Increased Deployment of Technology

2.3 Economic Outlook

2.4 History

Highly fragmented, low technology, and low cost

Changes in regulations

Waste disposal crisis of the late 80's

Economic and political incentive to increase recycling

Incentive to shop for lower disposal fees

Barriers to mobility: Flow control, Import bans and other legislative obstacles

Waste is increasingly hauled further away from the source of its generation

Effect of regulation on industry participants

Overbuilding and excess disposal capacity

Rising role of the private sector

Rising materials recovery rates

Problem of demand and capacity for recovered materials

Reengineering manufacturing to take advantage of recovered materials

Maturing market for recovered materials

3 SOLID WASTE MANAGEMENT

3.1 Industry Overview: Size and Segments

Defining the Market

Key Segments

Key Players

Supremacy of the publicly traded companies

Pricing Discipline

Rising Fuel, Equipment, Insurance and Labor costs may provide incentive to hold pricing

Waste by Rail

Personnel

M&A Activity

Vertical Integration through roll ups and "tuck-ins"

Efficiency through Technology and Route Optimization

Full Service Approach

Repackaging themselves as Green Companies

3.2 Industry Overview: Total Generation, Recovery & Disposal

Municipal Solid Waste Generation and Disposal Trends

Industry Consolidation

Growing Network of Transfer Stations

Solid Waste Management Segments

3.3 Collection Markets

Waste Collection

Waste Collection Technology

3.4 Processing Markets

Transfer and Processing

Early Gains

Helped by higher pricing

Diversion and Product Stewardship

Take Back Programs

3.5 Disposal Markets

Disposal Segment

C&D Volumes Improving with the Economy

3.6 New Disposal Technology

Bioreactors

3.7 Landfill Development and Operating Costs

Development Costs

Construction Costs

Closure and Post Closure Costs

Annual Operating Expenses

Other Economies-of-scale

Resource Recovery

3.8 Incinerator Operating Costs

3.9 Waste Management Market Dynamics and Geographic Distribution

3.10 Movement of Waste and Attempts to Control its Destiny

Flow Control

Waste by Rail

Interstate Waste Movement

3.11 Processing and Disposal Volume by Region

4 COMPETITION IN SOLID WASTE MANAGEMENT

4.1 Top Solid Waste Management Companies

Leading Waste Management Firms

4.2 Leading Firms in Waste to Energy

4.3 Industry Mergers and Acquisitions

Trends to look for in the coming year:

4.4 Municipal Solid Waste Authorities

5 LANDFILL CAPACITY

6 DISPOSAL VOLUMES AND PRICING

7 MATERIALS RECOVERY

Market Definition

7.1 Market Review

7.2 Resource Recovery Market

Introduction / Recent Events

A Brief History of Recycling

Economics of Recycling

Collection Methods: Single-stream vs. Dual-stream

Changing Composition of Recyclables

The Great Wall of China

The Good News

State Legislatures Push More Recycling Measures Including Landfill Bans

"Circular economy" and "zero waste"

Product Stewardship

Electronics Products Stewardship

Life-Cycle Assessment

7.3 Paper Recycling

7.4 Plastic Recycling

7.5 Aluminum Recycling

The Future

7.6 Steel Recycling

7.7 Glass Recycling

7.8 Largest Recycling Companies

8 OTHER SOLID WASTE MANAGEMENT SEGMENTS: SPECIAL AND INDUSTRIAL WASTES

8.1 Scrap Tire Recycling

8.2 Construction & Demolition Debris Disposal and Recycling

Some Definitions:

Relevant Regulations

Components of Construction and Demolition Debris Wastes

C&D Pricing follows a similar pattern to that of MSW

MSW Pricing Historically Reflects Ratio of Demand for Disposal to Available Capacity (Supply)

Available Disposal (Supply) is Represented by Proximity to Landfills and Waste-to-Energy Plants

8.3 E-Wastes

Need for Recovery

European Model

Take-back Programs

Manufacturers Approach

Firms Engaged in Recovery

Lack of Regulation Deters Investment

Lack of Regulation and Certification

Exporting E-Waste

Responsible Management

Screwdriver Operations

Should E-waste Recycling Count Towards State Goals?

8.4 Lamp Recycling

9 WASTE CONVERSION

Overview

Business Climate for Waste Conversion

9.1 Waste-to-Energy

9.2 Food Wastes

Definition

Food Waste Recycling

Unique Challenges

States are Looking to Food Waste as Next Great Opportunity to Meet Recycling Goals

9.3 Yard Waste and Composting

Definition

Source Separation of Organics (SSO) Advances Slowly

Divert, Don't Dump

Anaerobic Digestion Emerging

Large Capacity AD

Compostable Organics out of Landfills by 2012; COOL 2012

Composting Trends

9.4 Wood Wastes

9.5 Biogas (Anaerobic Digestion)

9.6 Landfill Gas

9.7 Waste-to-Ethanol

9.8 Waste-to-Chemicals

9.9 Autoclaving

9.10 Gasification and Pyrolysis

9.11 Plasma-arc

Existing facilities

Planned facilities

10 STRATEGIES FOR SUCCESS

11 WASTE MANAGEMENT EQUIPMENT

11.1 Waste Management Equipment Market

Rising Steel Prices and Other Problems

11.2 Waste Management Equipment Company Profiles

11.3 Leading Companies in Waste Management Equipment

View the Table of Contents, List of Exhibits, and List of Tables.

Report Provided in Hardcopy and Electronic Formats, including a Spreadsheet!

In addition to the hardcopy, the report comes in three electronic formats: an Acrobat (pdf) file of the book, an Excel Spreadsheet with detailed data tables, and a PowerPoint presentation that contains both data and summary bullet points. The spreadsheet data is broken out by state, region and national and includes historical data back to 1991 and projections to 2023.

(363 pages. $995 - 365-day download access. If an updated version becomes available within 365 days of your purchase, you will have access to the new version too!)

Waste Business Journal's

Waste Market Overview & Outlook 2019

(Data updated through 2018!)

Product package includes an Acrobat file of the full report, an Excel spreadsheet of the data and a PowerPoint presentation.

Book and CD-ROM package: $995.

TO ORDER call 619.793.5190 or: